Hairdressing services and beauty salonsĪs explained in this short text, a simple ticket or receipt is not valid as an accounting receipt or to deduct VAT.Services provided by dance halls and discos.Transportation of people and their luggage.Services provided by photographic studios.When the amount is less than 3.000 euros, VAT included, and document one of these operations:.

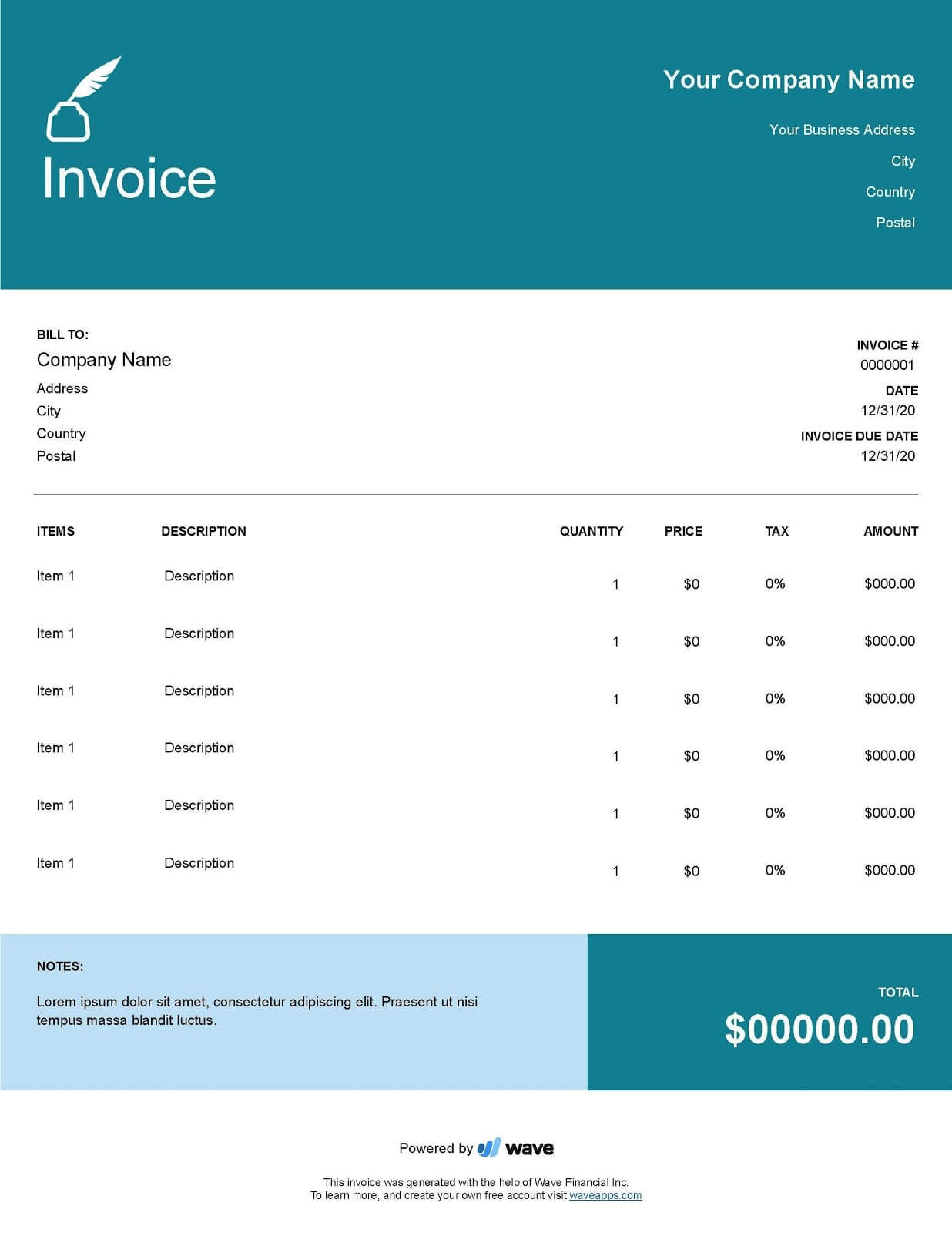

NIF or CIF and fiscal data of the buyer.In Spain, an ordinary invoice must include: However, all these data need to be reflected on a ordinary invoice. An example of the receipt would be the typical ticket they give you when you buy in the supermarket or after refuelling at the gas station.Ī normal receipt contains a date and a more or less detailed breakdown of what you have paid, but it lacks basic information for your accounting such as the buyer and seller or the breakdown of related taxes. In Arintass we explain you the differences between receipt and invoice and which type of document is necessary in each case:Ī receipt is nothing more than a proof of a payment and has no more value than the informative one.

0 kommentar(er)

0 kommentar(er)